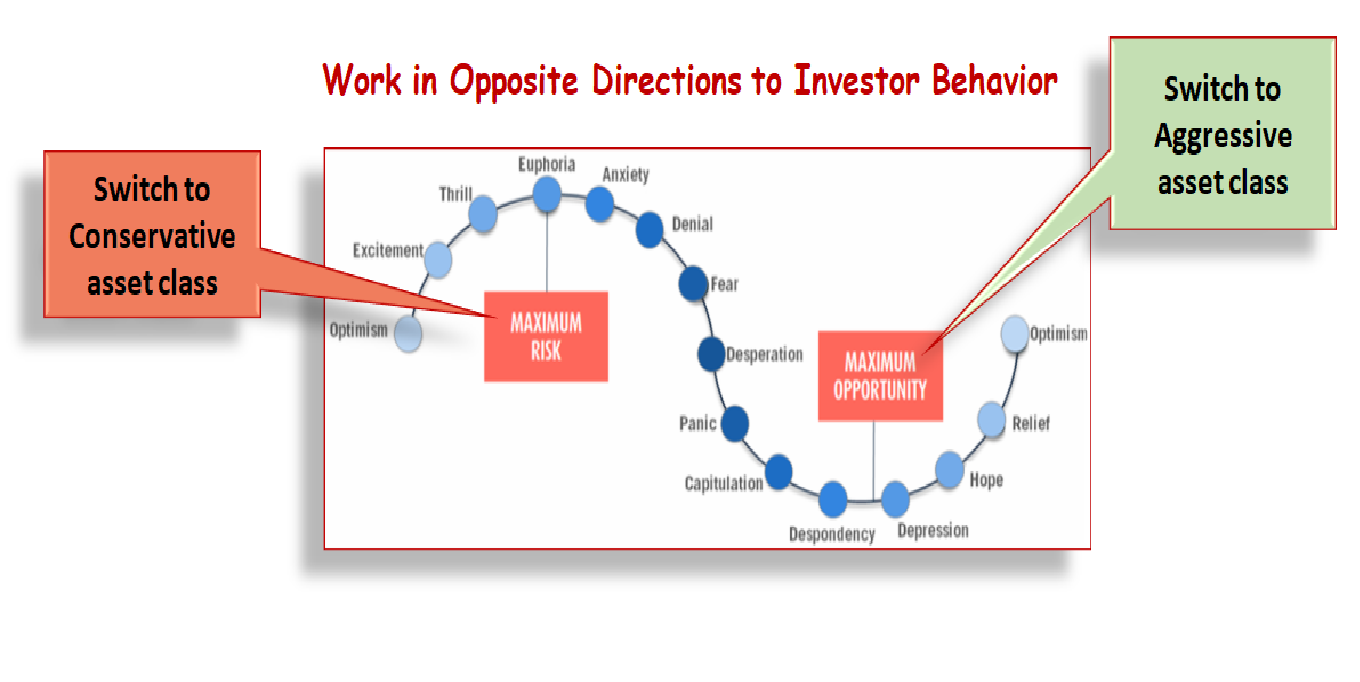

BUY & HOLD V/S SMART INVESTING

Buy & hold mutual fund investing is a passive investment strategy where an investor purchases a mutual fund and holds onto it for an extended period, typically for many years.

SIP karo bhul JAO

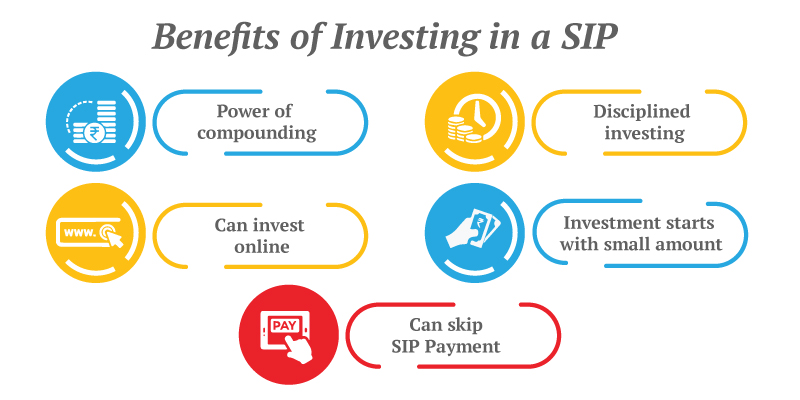

Best SIP Funds is a list of hand-picked Mutual Fund Schemes that have given better SIP returns compared to other Funds in same category. This means these Funds stick to their investment philosophy in difficult times & aren't afraid of temporary correction in the prices of the Stocks in their Portfolios & hence generate better returns over long term for their SIP investors.

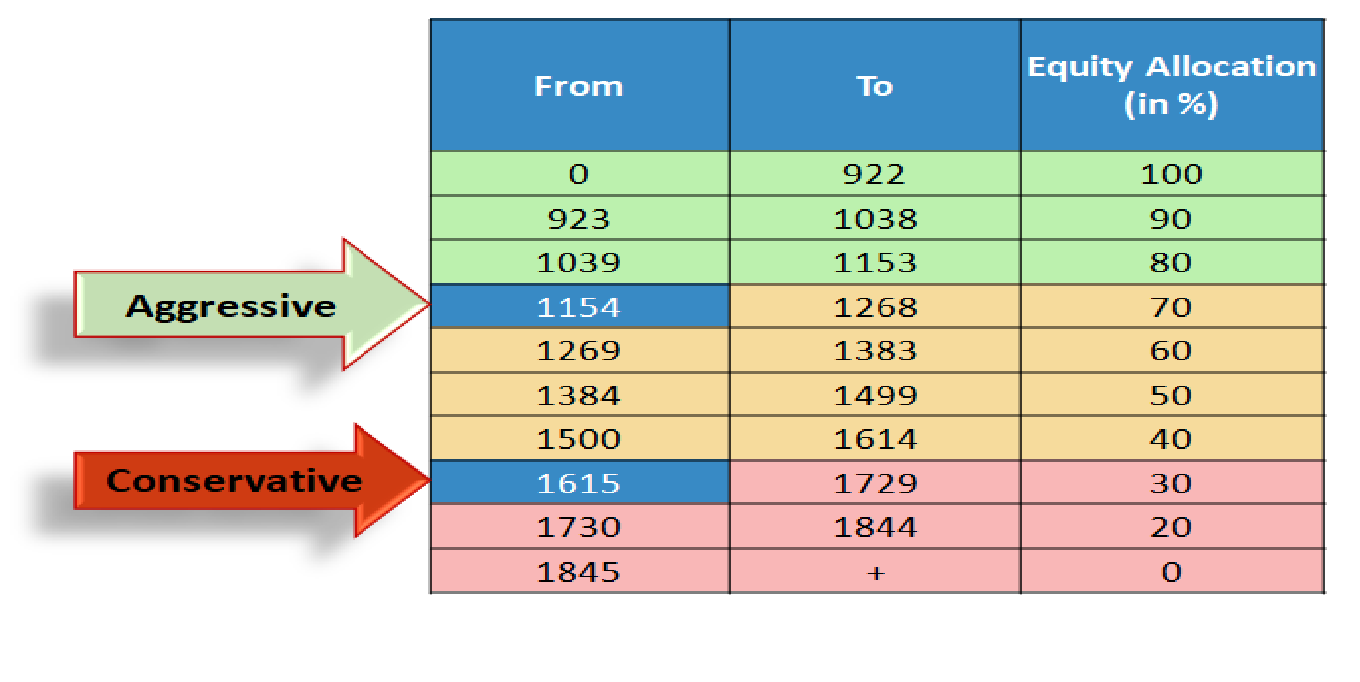

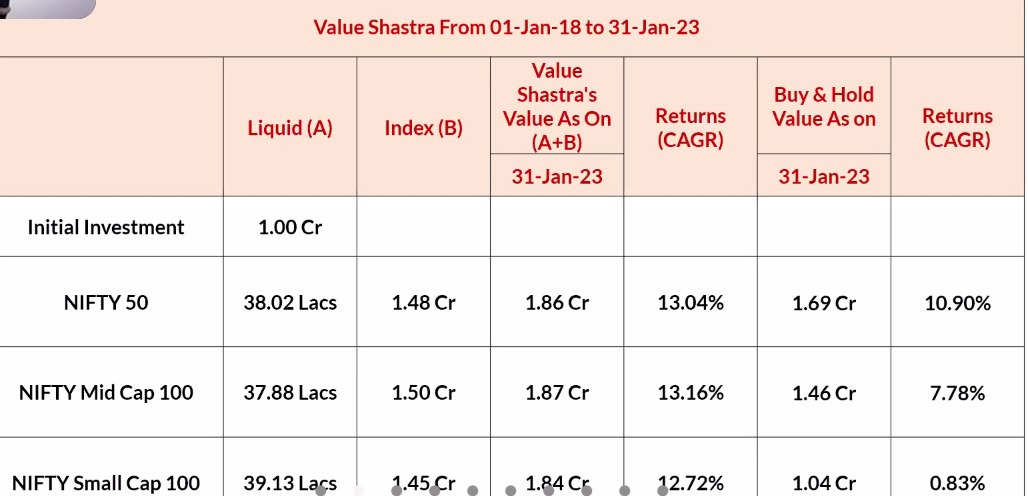

Regular STP vs Value STP

Is STP good for mutual fund? STP route is best for all those investors who wish to invest a lump sum in mutual fund schemes because this way they get the dual benefits of comparative risk investment. Investing a large amount of money in one go in equity oriented mutual funds can be risky.

Disclaimer

www.modiinvestmart.com is an online website of Mr. Arbind Modi registered vide ARN-111674 as a AMFI Registered Mutual Fund Distributor. The said website is intends to provide educative and informative details related to investments and also provide online transaction facility in Mutual Funds. We do not charge any fees for any of these calculators and information, because we earn our commissions from the Mutual Fund companies. The website does not guarantee any returns or financial goal success by any means. Mutual fund investments are subject to market risks. Please read the scheme information and other related documents carefully before investing. Past performance of the schemes is neither an indicator nor a guarantee of future performance.